Stay compliant. Stress-free. Year-round.

Save on taxes, form your S-Corp today

S-Corp formation could save you thousands in self-employment taxes.

S-Corp formation

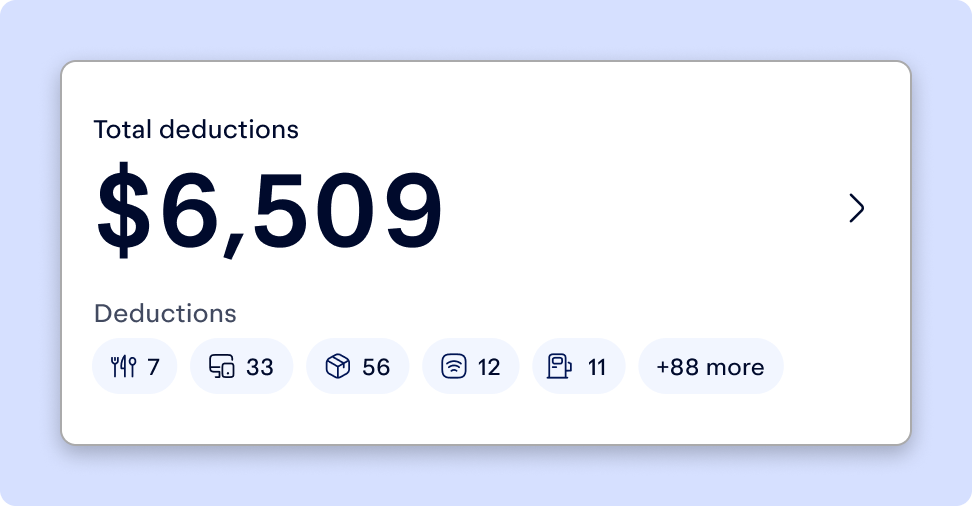

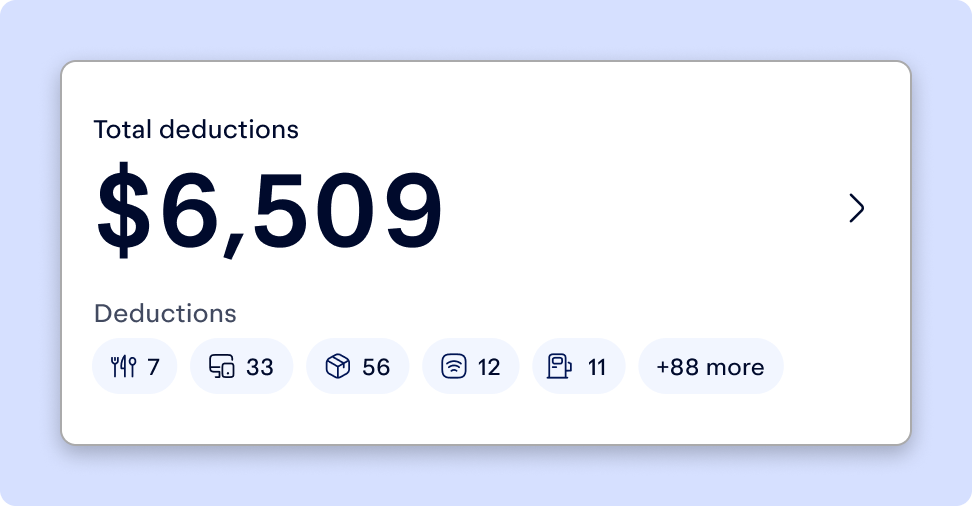

Automatic expense tracking

Quarterly tax support (Form 1040-ES)

File individual federal & state returns

Audit protection & resolution

Expert tax advice year-round

1:1 call with an accountant every quarter

Everything in Premium Plan

Quarterly tax support (Form 941)

S-Corp tax filing

Annual tax strategy session with a dedicated accountant

Year end book review and close

An S-Corp is a tax status you can choose with the IRS. It’s not a type of business like an LLC. LLCs give you legal protection. But an S-Corp helps you save on taxes once you're earning real profit.

Here’s how:

Instead of paying 15.3% self-employment tax on all your income, an S-Corp lets you split it:

That split alone can save you thousands of dollars!

Nope! You can form a corporation and elect S-Corp status directly. But here’s what most solopreneurs do:

Why it matters: The LLC gives you legal protection. The S-Corp gives you tax savings. Best of both worlds!

If your net profit (that’s income after expenses) is $60,000 or more, an S-Corp can save you thousands on taxes each year. If you earn below that, it might not be worth the extra complexity yet.

Why $60,000? That’s the point where the savings outweigh the extra admin work like payroll and filings.

An S-Corp saves you money on self-employed taxes by letting you split your income into:

Instead of paying 15.3% self-employment tax on everything like an LLC, you only pay it on the salary portion.

Real-world example: Make $100K profit? Pay yourself $50K salary → save $7,500 in taxes.

Yes, it’s legit. And yes, the IRS allows it—if done right.

You’ll use a payroll provider to pay yourself a regular W-2 salary. The rest of your profit? You take it out as an “owner’s draw” or distribution.

Think of it like this: You’re both the boss and the employee. The IRS wants you to act like it.

The IRS expects you to pay yourself a salary that’s fair for your role. Not too low (they don’t want you avoiding taxes), and not over the top.

Here’s how to calculate a reasonable salary:

Tip: When in doubt, Keeper’s tax pros can help you set a defensible number.

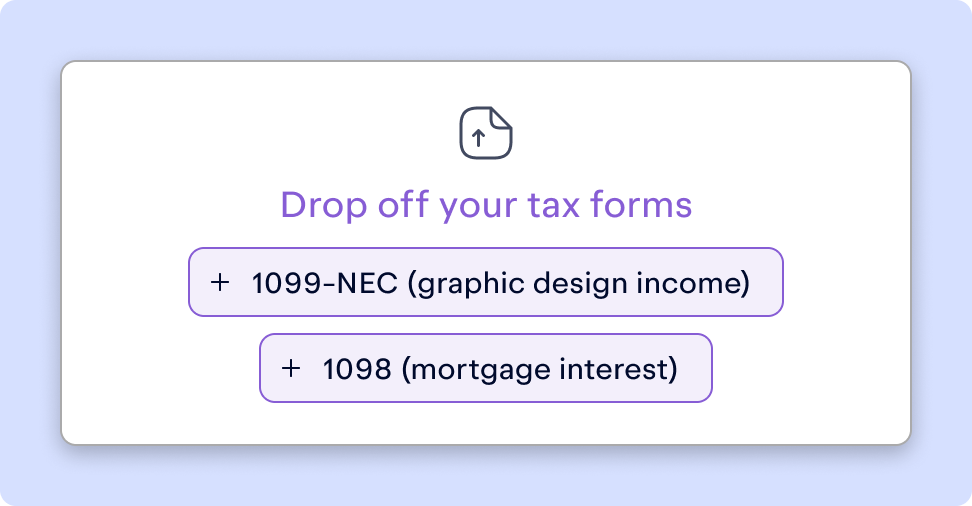

Here’s what your tax filing form checklist looks like:

Bonus points: You’ll also send yourself a K-1 to show your share of profit.

Absolutely! You can still deduct:

S-Corp or not, write-offs = less taxable income = lower tax bill if you make any 1099 income.

Yes! Whether you’re an LLC taxed as an S-Corp or a full-on corporation, you still get limited liability protection, meaning your personal stuff (car, home, savings) is shielded if the business is ever sued.

Important: Keep your business and personal finances separate to make sure that protection holds up.

There are a few downsides to becoming an S-Corp:

But if you’re growing? The tax savings usually make it very worth it!

It’s easier than you think! Here’s the quick path:

Pro tip: You’ve got a 75-day window after forming your LLC to make the election for the current year.

Keeper provides step-by-step guidance from licensed tax pros, if you want to skip the manual work and get it done quickly and accurately!