- You only need to file an amendment for major changes like filing status or additional credits and forms.

- You have 2-3 years to file an amendment.

- They take 8-12 weeks to process.

- You can e-file with Keeper or you can mail in your return to the IRS.

When should you amend a tax return?

Before we touch on how to amend your tax return, let’s start with the reasons you would file an amended return. At Keeper, the two most common reasons for filing an amended return are:

- Claiming deductions that you missed or didn’t know about, typically as a self-employed taxpayer

- Reporting an additional form that you forgot or came late.

The IRS advises that you should amend your tax return if you need to complete any of the following:

- Correct your filing status

- Add or remove dependents

- Report additional income you forgot to include

- Claim deductions or credits you missed

- Fix mathematical errors (though the IRS often corrects these automatically)

- Change from standard deduction to itemized deductions, or vice versa

- Report additional tax documents that arrived after filing (like a corrected 1099)

You do not need to amend for simple math errors or missing forms that don't change your tax liability, as the IRS typically handles these administratively.

What are some forms don’t change your tax liability?

- Multiple 1099-INTs from the same bank: If you already reported all your interest income correctly, getting additional 1099-INTs that just break down the same total won't change anything

- Corrected 1099s with same totals: A 1099-DIV that corrects the breakdown between ordinary dividends and qualified dividends but shows the same total income

- Form 1095-A, 1095-B, or 1095-C (health insurance coverage): These are mainly for your records unless you're claiming premium tax credits

- Form 5498 (IRA contributions): This reports contributions you already know you made

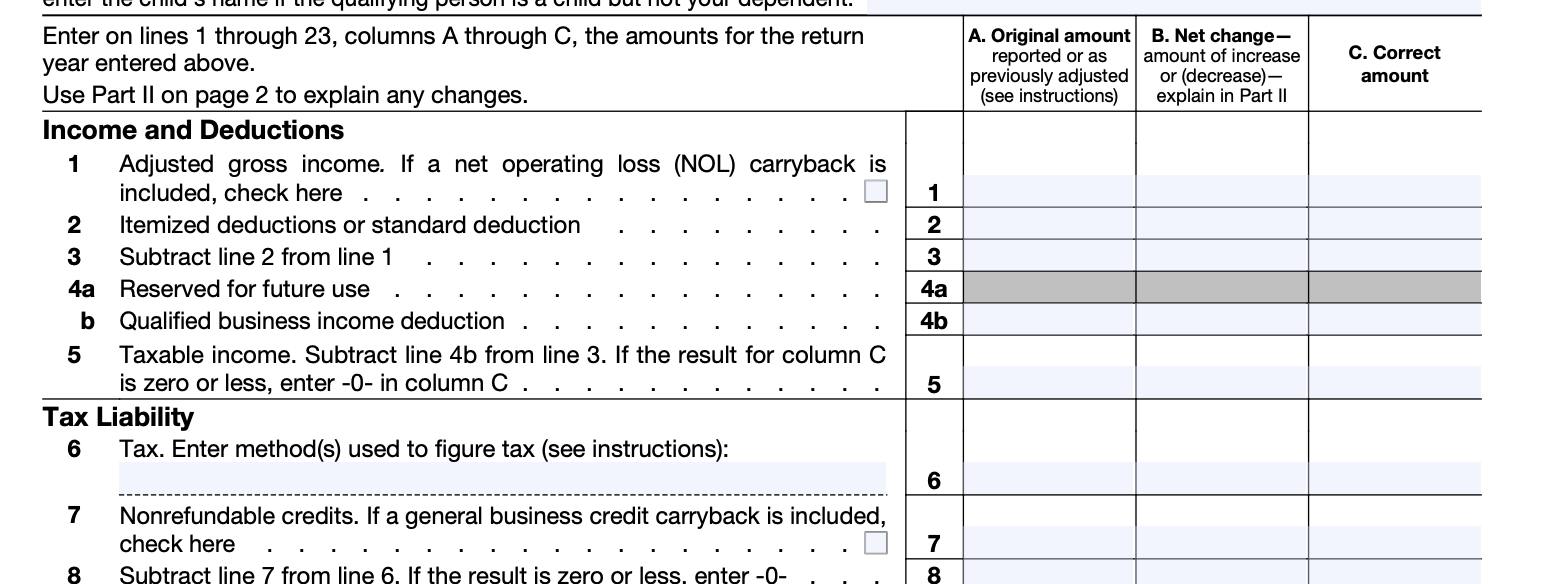

The form you'll need to amend your taxes: Form 1040-X

To amend your federal tax return, you'll use Form 1040-X (Amended U.S. Individual Income Tax Return). This form allows you to explain what you're changing and why, showing the difference between your original return and the corrected version.

Form 1040-X has three columns:

- Column A: Original amounts from your filed return

- Column B: Net changes (increases or decreases)

- Column C: Correct amounts (Column A plus or minus Column B)

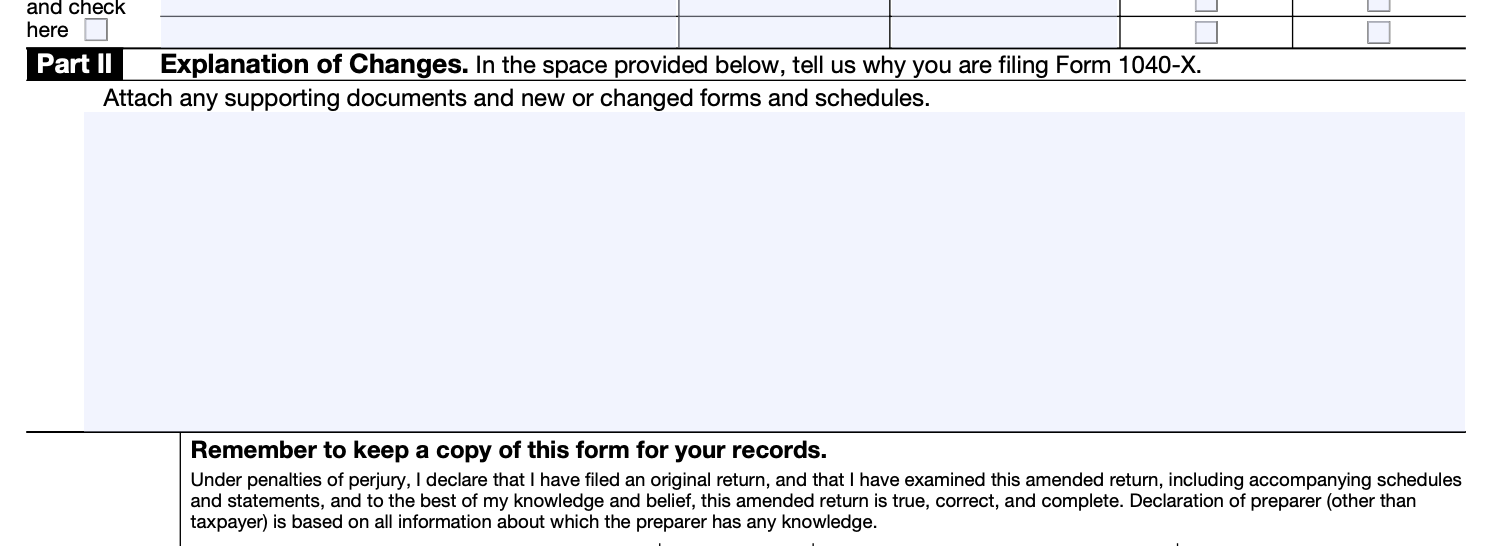

You also have a field (Part II) to explain exactly what changes you’re making and why. This part is critical to making sure your amendment is processed and approved quickly.

Additional forms you’ll need based on your amendment reason

Schedule A (Itemized Deductions)

Why you'd add it:

- You originally took the standard deduction but later realized your itemized deductions exceed it

- You forgot to include major deductible expenses like large medical bills or charitable donations

Example: After filing, you discover receipts showing $15,000 in medical expenses (above the AGI threshold) plus $8,000 in state taxes and $12,000 in mortgage interest. Your total itemized deductions of $35,000 exceed the standard deduction, so you'd attach Schedule A to claim the higher amount.

Schedule C (Business Income/Loss)

Why you'd add it:

- You received a 1099-NEC after filing for freelance work you forgot about

- You started a side business late in the year and forgot to report it

Example: You received a 1099-NEC in May for $3,500 in consulting work you did in December but forgot to include on your original return. You'd file Schedule C to report this self-employment income and pay the additional taxes.

Schedule D (Capital Gains/Losses)

Why you'd add it:

- Your broker sent a corrected 1099-B showing different investment gains/losses

- You forgot to report stock sales or cryptocurrency transactions

Example: You sold stocks in December but your 1099-B arrived after you filed. The sales resulted in $2,000 in capital gains you need to report, requiring Schedule D and Form 8949.

Schedule SE (Self-Employment Tax)

Why you'd add it:

- You had self-employment income over $400 that you forgot to report

- You need to correct self-employment tax calculations

Example: That $3,500 consulting income from the Schedule C example above would also require Schedule SE to calculate and pay self-employment tax of approximately $494.

Schedule EIC (Earned Income Credit)

Why you'd add it:

- Your income was lower than you initially calculated

- You had a qualifying child you didn't claim

Example: After reviewing your records, you realize your AGI was $28,000 (not $32,000 as originally filed) and you have one qualifying child, making you eligible for an Earned Income Credit of approximately $3,500.

Form 8863 (Education Credits)

Why you'd add it:

- You received a 1098-T after filing showing qualified education expenses

- You forgot to claim the American Opportunity Credit or Lifetime Learning Credit

Example: Your college-age dependent's 1098-T showed $8,000 in qualified tuition expenses. You could claim the American Opportunity Credit worth up to $2,500.

Form 5695 (Residential Energy Credits)

Why you'd add it:

- You installed solar panels, energy-efficient windows, or other qualifying improvements

- You forgot to claim credits for energy-efficient home improvements

Example: You installed a solar panel system costing $15,000 in December. You could claim 30% of the cost ($4,500) as a federal tax credit using Form 5695.

How to amend your tax return step by step

1. Gather Your Documents

Before starting, collect your original tax return, all supporting documents, and any new forms or receipts related to the changes you're making. Make sure that you submit all the same forms and schedules on your amended return as you did on your original return, even if you’re only updating a few.

2. Complete Form 1040-X

Fill out the form carefully, explaining your changes in Part III. Be specific about what you're correcting and why. The IRS needs to understand the reason for each amendment.

3. Attach Supporting Documentation

Include any new forms, schedules, or documentation that supports your amendments. If you're claiming additional deductions, attach receipts or other proof.

4. File Your Amendment

Historically, the only way to file amended returns was via mail, but now you’re able to submit your Form 1040x electronically with tax software providers, like Keeper! If you want help with that, click here to get started.

How to amend your tax return with Keeper

Keeper was designed to make complex taxes easy, and one of those complexities is amendments. Here’s how the amendment process works when you use Keeper.

1. Sign up for Keeper

Before we can get started amending your return, we’ll have you create an account. We’ll ask a few questions about your tax situation and even help you find missed deductions (if you didn’t track yours).

2. Upload your documents

If you’ve already filed your taxes with Keeper, we’ll have your current tax return, so we’ll just need any new documentation that you’d like to submit: deductions, forms, etc… If you haven’t filed with Keeper yet, no worries - you’ll just upload your documentation you have for the current tax year, including your most recent tax return, and we’ll handle prepping the amendment.

3. Tell us what you need done

Let us know what you need done to your return: adding extra deductions, reporting a forgotten form, etc…, and we’ll have a tax pro handle it all for you! You don’t have to worry about understanding Form 1040x or adding info box by box. We’ll do the legwork to make your tax return perfect.

4. Keeper files federal and state amendments for you

Once your return is ready to go, we’ll send it to you for a final review before sending it off to the IRS. If your amendment results in a bill, we’ll assist you in setting up your payments. In the more fun case where your amendment results in a refund, we’ll make sure that gets to you ASAP.

{upsell_block}

How long do you have to file an amended return?

If you’re expecting a refund: The Three-Year Rule

You have three years from the original filing deadline (or two years from when you paid the tax, whichever is later) to file an amended return claiming a refund.

Example: Let's say you filed your 2024 tax return on time in April 2025, but later discovered you forgot to claim a $1,000 business deduction that would result in a refund. You would have until April 15, 2028 (three years from the original 2024 filing deadline of April 15, 2025) to file Form 1040-X and claim that refund.

However, if you filed that same 2024 return late—say in August 2025—you'd still have until April 15, 2026 to amend, because the deadline is based on the original due date, not when you actually filed.

There are a few nuances here for special cases like being in a combat zone or federally declared disaster area, as well as some claims like bad-debts or worthless securities. If your situation falls outside the norm, it’s best to talk to a Keeper tax pro to get the latest and most accurate information.

If you owe a tax bill

If your amendment shows you owe more tax, there's no deadline for filing the amended return, but you should file and pay as soon as possible to minimize interest and penalties. The IRS charges interest from the original due date of the return.

Where’s my amended return?

If you’ve already filed an amended return and want to check its status, you can do that on the IRS’s website here. You should expect your amended return to take 8-12 weeks to process, but sometimes it can take as long as 16 weeks.

To use the IRS’s tool, you will need to have a few things ready:

- Social Security number

- Date of birth

- ZIP Code

Common mistakes when amending your taxes

- Filing amendments for the wrong reasons.

- The IRS can correct simple math or clerical errors on its own, yet many taxpayers file amended returns for issues like, basic arithmetic errors, missing signatures, and forgotten forms that don't change tax liability.

- Filing Multiple Amendments Too Quickly.

- Many taxpayers file a second amendment before the first one is processed, creating confusion and delays. Each amendment can take 8-12 weeks to process.

- Missing Supporting Documentation

- Not attaching required schedules, forms, or supporting documents for new deductions or credits being claimed.

- Not Amending State Returns

- Changes to your federal return often have resulting impacts on your state return. Don’t want to deal with that? Use Keeper to file an amendment for you.

- Inadequate Explanations in Part II of 1040x

- Failing to clearly explain what changed and why in the explanation section. The IRS needs to understand:

- What specific items you're correcting

- Why the change is necessary

- How you calculated the adjustment

- For example: Original return line 1: $50,000. Corrected return line 1: $55,000. Explanation: I received a corrected 1099-NEC from [Company Name] showing an additional $5,000 in income, which was not included on the original return.

- Failing to clearly explain what changed and why in the explanation section. The IRS needs to understand:

FAQs

How many amendments can you file?

The IRS allows you to file up to 3 amendments per tax year. It’s important that you wait for each amendment to fully process before you try to file another one.

What to do if your original return was rejected?

If your original return was rejected (e.g., due to a simple error like an incorrect Social Security number), you should correct and resubmit the original return, rather than filing an amendment.

Sign up for Tax University

Get the tax info they should have taught us in school

Expense tracking has never been easier

Keeper is the top-rated all-in-one business expense tracker, tax filing service and personal accountant.

Get started

What tax write-offs can I claim?