What is a 1099-K from Square?

Your Square 1099-K shows how much you earned in business income from Square in a year.

Let’s take a step back. The 1099-K is a form that documents how much self-employed people earn through credit cards and third-party apps — like Square.

Any payment processor that allows people to make business transactions on their platform has to send out 1099-Ks to all the freelancers and business owners that use it. It doesn't matter if you do 1099 work full-time or if you have a part-time side hustle — if you meet the income threshold (more on that in a second), you should get the form.

{write_off_block}

The difference between 1099-K and 1099-NEC

Why doesn’t Square send a 1099-NEC? If you work for yourself, you’re likely also familiar with this form (and with the one that it replaced, Form 1099-MISC.)

Just like 1099-Ks, the 1099-NEC reports your self-employment income to the IRS. The main distinction is that they report income paid in different ways.

- 1099-K reports income you earn through third-party settlement organizations, including payment apps, debit cards, credit cards, and credit card processors — like Square!

- 1099-NEC reports income you earn through cash, checks, electronic fund transfer, or direct deposit

What if you have customers that pay you through Square and customers that write you a check? In that case, you might get both types of forms when you’re filing your self-employment taxes.

{filing_upsell_block}

Who should get a 1099-K from Square?

For the 2023 tax year (for which you file in 2024), Square is required to send the form only to users who:

- Earned more than $20,000 in self-employment income

- Had over 200 business transactions

They’ll also send the same form to the IRS.

Originally, a new IRS rule was going to shift the threshold down to only $600, across any number of transactions. That would've forced Stripe to send out a lot more 1099-Ks. However, the IRS delayed that 1099-K threshold change, so the above rules still apply for 2023.

For the 2024 tax year, the threshold is set to change to $5,000. This is intended as a "phase-in" to the eventual $600 threshold, which the IRS still plans to implement at some point.

Why did the IRS delay the $600 rule?

It's because they got "pushback from major financial institutions and payment processors," says Kristine Stevenson Seale, EA, a tax resolution specialist and author.

Do you have to report your Square income if you don’t get a 1099?

Sadly, yes. People who don’t qualify for a 1099-K still have to report their Square income to the IRS when they file their taxes.

"Report the income if [you have] more than $400 of self-employment income," says Seale. "The reporting requirement exists whether you get a form... or not."

Not sure how much you made through Square? Don’t worry: If you processed less than $600 in transactions, you can view and download your year-end sales report from your Square Dashboard.

When and how do you get your Square 1099-K?

While some companies will send you a copy of your 1099-K, Square typically only makes the form available through their online Square Dashboard (That’s actually better for you, especially if you like to get your taxes done early: you won’t have to wait on USPS!)

Here’s how to find and download yours:

- Head to your Square Dashboard

- Go to “Accounts & Settings”

- Select “Business”

- Choose “Tax Forms” from the dropdown menu

- Click on “1099-K”

The form should be available by January 31st. If it’s not, contact the Square support team, and they can help you track it down.

How to update your EIN

If you file your taxes using a business name or EIN (Employer Identification Number), you should double-check that your Square account is updated with both.

Otherwise, your tax forms will show your name and Social Identity Number (or ITIN) by default. That could cause a delay in your tax return being processed — and make you have to wait extra for your refund if you’re getting one.

To update your EIN and business name:

- Follow steps 1-4 above

- Under “Taxpayer Information,” select your account

- Enter your business name and EIN

This will automatically update your 1099-K with the correct information!

{email_capture}

How to do your Square 1099 taxes

Now that you’ve got your Square-1099-K sorted out, the main steps of filing your 1099 taxes can be counted on one hand. The really good news is, you’ve already gone through Step 1:

- Figure your total income and transaction information using your 1099-Ks and 1099-NECs

- Make a list of all your eligible write-offs — including your Square fees!

- Fill out Schedule C to determine your taxable income, which is total income minus your write-offs

- Calculate how much you should set aside for your 1099 taxes

- Double-check if you need to pay your taxes quarterly

Now, let’s talk about the most exciting step: finding your write-offs!

Writing off Square 1099 business expenses

Once you’ve got all of your (updated) 1099s together, they can help you add up your gross income from the year.

Now it’s time to find eligible write-offs. This will lower your taxable income — and ultimately, your tax bill!

Keeping track of the money you spend on your business throughout the year can have big money-saving benefits come tax time. That’s because you can deduct a portion of most business expenses from your gross income, helping you to hang onto as much of your earnings as possible.

One of those write-offs is Square fees!

How to write off your Square fees

When you get your 1099-K, you might be alarmed to see a gross sales number higher than what shows up in your bank statements. That’s because Square takes a cut when it transfers funds to your bank account.

But don’t worry! You can write off these transaction fees as a business expense. Do that, and your taxable income will better reflect the money that actually made it into your pocket.

Find out how much you paid Square

Here’s how to find the exact amount of Square fees you’ve paid:

- Head to your Square Dashboard

- Select “Reports”

- Click “Sales Summary”

- Enter in the dates you want to view

- Scroll down to “Fees”

Write off your Square fees on Schedule C

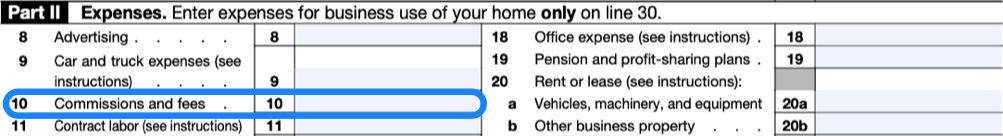

Once you have that number, record it with the rest of your write-offs on Schedule C. (More on that in a bit!) You can use Box 10 of Part II, for commissions and fees.

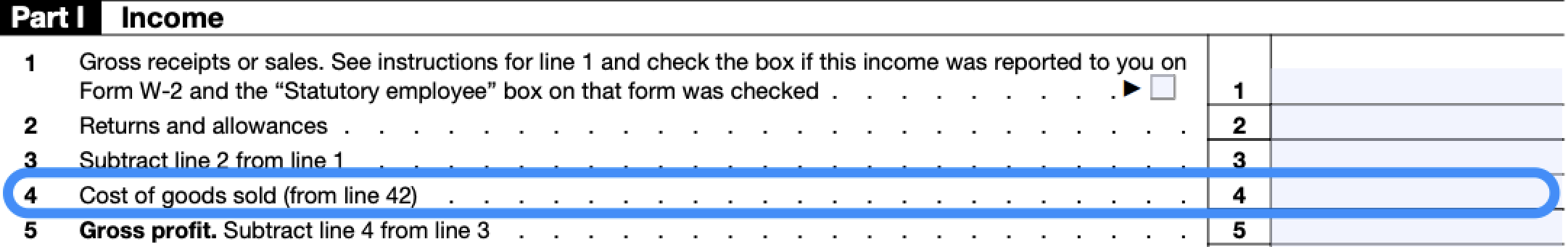

Alternatively, if you sell products, you can include it in Box 4 of Part I, “cost of goods sold.”

Other common 1099 write-offs

Square fees are just one eligible write-off. Depending on what kind of 1099 work you do, there are lots of other business expenses you might be able to deduct from your gross income during tax season.

Here are some common examples:

- 💳 The cost of your Square reader

- 👩⚖️ Business entity or legal fees

- 🏫 Training you take to improve your products, services, or business

- 🏢 The cost of renting an office space

- 🏠 Home office deduction, if you work from home

- 📞 A portion of your phone bill

- ⚡ A portion of your internet bill

- 💻 Your laptop, computer, or other work equipment

- 🍣 Business meals

- ✈️ Business-related travel

- 🚗 Vehicle expenses if used for work

- 💼 Employee payroll

- 💰 Business insurance

- 🏦 Business loan interest

- 📰 Advertising or marketing fees

Once you’ve got all of your write-offs sorted, you can fill out your Schedule C, which will determine your taxable income. And if you want a hand with the form, check out our guide to completing your Schedule C.

Make the most of your write-offs with Keeper

If all this feels like a lot to keep track of, don’t worry. There are tools out there to help you save money on your taxes by tracking your write-offs, like Keeper!

{write_off_block}

If you download the app and connect it to your bank account, it’ll automatically identify and track eligible business expenses as you spend — ensuring you can make the most of your write-offs when it’s time to file. It can also retroactively go through your previous statements to find write-offs, so no worries if you download it in the middle of the tax year.

The app is $20/month — and the cost is also an eligible write-off!

But tracking your expenses is just one part of staying on top of your taxes. Another part is making sure your Square recordkeeping is in good shape, so you can avoid issues like double reporting.

When are my Square 1099 taxes due?

If you’re a self-employed person, you can do your taxes in April, just like everyone else. But if you’re expecting to owe over $1,000, you’ll be expected to pay your taxes on a quarterly basis.

Here when taxes are typically due if you’re required to pay every quarter:

- Quarter 1 - April 15th

- Quarter 2 - June 15th

- Quarter 3 - September 15th

- Quarter 4 - January 15th

Knowing how much you have to pay for each quarter can be tricky — and underpaying can result in penalties. But don’t sweat: Our free quarterly tax calculator can help you determine how much you should be paying.

At the end of the day, Square doesn’t make filing your 1099 taxes more complicated. So long as you keep your information updated in your Square Dashboard, you should be able to access your 1099-K form by January 31. And from there, it’s just about totaling your gross and taxable income.

But if you do have more complex 1099 taxes and could use an expert in your corner, feel free to reach out. Our tax assistants are here to help!

File complex taxes confidently

Upload your tax forms and Keeper will prep your return for you. 100% accuracy and maximum refund guaranteed. Plus, a tax pro reviews and signs every return.

Sign up for Tax University

Get the tax info they should have taught us in school

Expense tracking has never been easier

Keeper is the top-rated all-in-one business expense tracker, tax filing service and personal accountant.

Get started

What tax write-offs can I claim?