Do I have to pay taxes on tips?

The short answer: Yes, tips are taxable. According to the IRS, all tips are taxable income, and must be reported on your tax return. That's true whether you’re a delivery driver juggling multiple apps like Gopuff and Instacart, walking dogs with Wag!, or a W-2 bartender working for a single restaurant.

if you’re working for tips, they can account for a significant amount of your income. The IRS knows this. You didn’t think they were going to ignore such a large slice of your earnings, did you?

Exactly how your tips get taxed, though, will vary. It depends on:

- What kind of work you do

- How you’re classified as a worker

NEW FOR 2025: No taxes on tips thanks to the One Big Beautiful Bill (OBBB)

Here's the good news. Starting with the 2025 tax year through 2028, eligible workers can deduct up to $25,000 in tips from their taxable income thanks to the One Big Beautiful Bill (OBBB)

Here's what you need to know about the tip deduction:

- The deduction applies for about 70 professions who the IRS has deemed "customarily and regularly" receive tips in their job.

- This deduction phases out for for high earners — taxpayers with a modified adjusted gross income (MAGI) over $150,000 (or $300,000 for joint filers).

- The deduction applies whether or not your itemize your deductions or take the standard deduction.

What counts as a tip?

Tips can take many forms. The most common types are credit card, debit card, or cash tips left when a customer pays their bill. But non-cash gratuities — like tickets to sporting events or gift cards — are also considered tips.

Anything you receive that has a value is considered a tip if it’s:

- ✓ Not mandatory based upon company policy

- ✓ Determined by the customer making the payment

Basically, if it’s given by someone who has a choice to leave money and gets to decide who to leave it to, then it’s a tip.

{email_capture}

Money from tip pools is a tip

Important note: The money doesn’t have to come directly from a customer to count as a tip. If you’re employed somewhere that uses a tip pool, any money you get from that pool counts as tip.

Service charges aren't tips

It’s important to point out the difference between a tip and a service charge.

Service charges are mandatory charges set by company policy. This includes things like:

- Bottle service charges

- Room service charges

- Delivery fees

- Large party surcharges

In these cases, the charges are mandated and collected by the business, not freely given by the customer. So they don’t count.

Are service charges taxed?

Now, you do have to pay taxes on any service charges that get paid out to you. But you won’t have to keep track of them like you do your tip: your employer will handle that for you.

Your portion of the service charge is included with your hourly wage in Box 1 when your employer provides your W-2. No additional work needed!

How are tips taxed?

Like with any other form of taxable income, you’ll have to pay federal income tax, Social Security tax, and Medicare tax on your tips. If you live in a state with an income tax, you’ll have to pay that as well.

Additionally, gig workers earning tips will need to pay self-employment tax on those tips.

Are tips taxed differently than wages?

The short answer: No. The slightly longer answer: No — but how they’re taxed depends on whether those tips are through a W-2 job or an independent contracting gig.

We’ll cover exactly how each is handled down below. But in a nutshell, you report and pay taxes on your tips the same way you report and pay taxes on the rest of your income from that job.

Earn tips as part of a W-2 job waiting tables? You’ll be taxed on them the same way you’re taxed on your paycheck from the restaurant.

On the other hand, maybe you drive for Uber and get tipped by your passengers. In that case, your tips will be taxed just like your payouts from the app.

{write_off_block}

How to report tips from gig work

When you drive for a rideshare service like Uber or Lyft, deliver groceries via Instacart, or engage in any other gig economy job, you’re classed as a contract worker. This means the company you work for won’t withhold any of your taxes, and you’ll need to file as a self-employed individual.

For any income you earned from tips, you'll need to report them to the IRS yourself. Luckily, it isn’t too complicated to do.

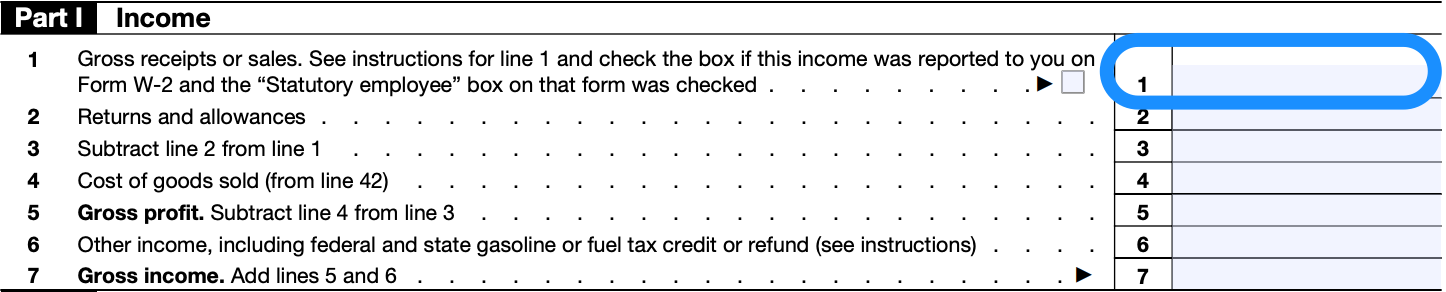

Reporting your tip income on your Schedule C

Reporting your tips from self-employment work is actually pretty easy: you add it to all your other gig earnings and fill it in on Line 1 of your Schedule C.

If you receive any tips through the gig app you’re using, it’ll show up in your income total on your 1099 form. However, you’ll need to track your cash tips yourself.

How to lower taxes on your gig work tips

Not all gig workers realize that their tips are taxable. If you’ve been going above and beyond for your customers all year, your hard-earned tips can make for a tax bill that’s heftier than expected.

Luckily, there’s a great way to lower your taxes without sparking the IRS's wrath: writing off your business expenses. Keeper will automatically find and deduct them, so that even once you add in your tips, you’ll never overpay your taxes again.

{upsell_block}

How to report tips from W-2 work

If you’re an hourly — or salaried — employee, your employer will keep track of what they pay you.

Your tips, though, work differently. You’re responsible for reporting your total tip income back to your employer. If you earn enough, you have to do this every single month.

Needless to say, doing extra paperwork every month is a huge hassle. Why is it required? At the end of the day, it’s because tips are taxable. And while it might be a chore, staying on top of it will save you a headache at tax time. Reporting your tips to your employer helps them withhold enough money on your paycheck to cover the taxes due on your tips.

Who needs to report tips to their employer?

You’ll only need to report your tips to your employer if they exceed $20 in a month.

Keep in mind: Even if you earn less than that, your tips are still taxable — you’ll still need to include them on your tax return at the end of the year. You just won’t have to report them to your employer too.

What happens if you don’t report your tips to your employer?

If you don’t report as required, you’ll be on the hook to complete Form 4137, Social Security and Medicare Tax on Unreported Tip Income. (The IRS isn’t going to just let those taxes go!) You’ll need to attach it to your tax return when you file.

Not reporting also puts you at risk for a penalty: up to 50% of the Social Security and Medicare taxes you owe on your unreported tips.

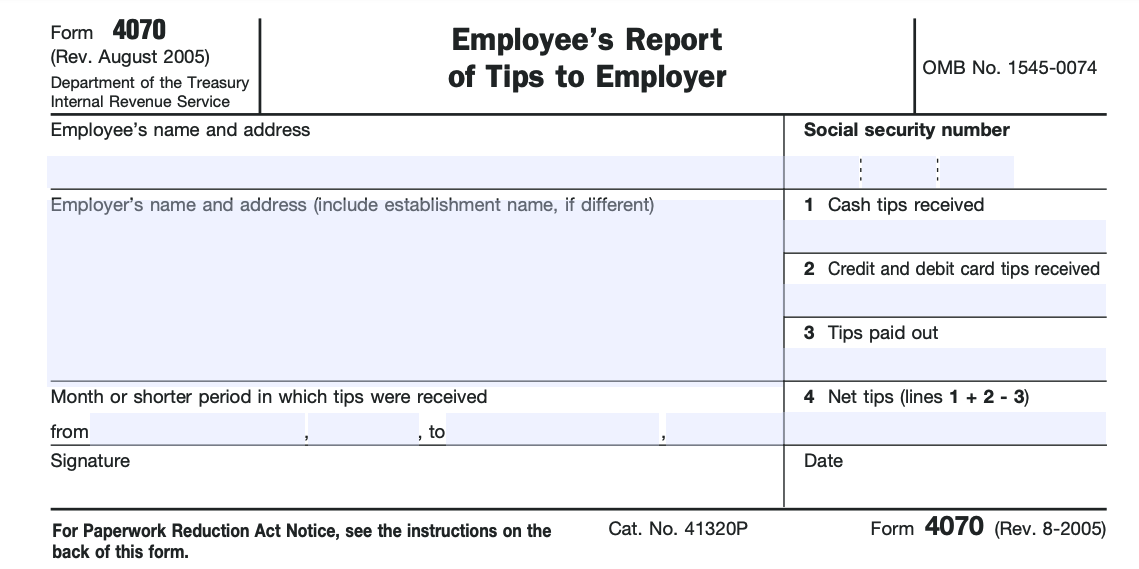

Reporting your tips to your employer using Form 4070

To report your tips to your employer, you’ll need to fill out a Form 4070, Employee’s Report of Tips to Employer.

This is due by the 10th of the month, and it covers the previous month’s tips. (You might have to submit it more often if your employer wants it to line up with their pay period).

Note: Form 4070 isn’t actually required. Some employers have their own tip reporting form, and that’s fine. The important thing is to report your tips in writing, and include:

- Your name, address, and Social Security number

- Employer’s name and address

- Month or period the report covers

- Total amount of tips received during the month or period

- Your signature

Your employer will use your monthly report to figure out how much they need to withhold from your paycheck to cover income and payroll taxes on your tips.

Tip reporting in action

Pretend you reported $2,500 worth of tips in June. Your total hourly wages for June were $500.

That means your employer will calculate payroll taxes on your total earnings, $3,000. They’ll then calculate how much to withhold from your paycheck to cover taxes on that $3,000.

What happens if the taxes on your tips are more than your paycheck?

If you earn a lot of tips, it’s possible for the taxes you owe on them to exceed your paycheck amount. That means your employer won’t be able to withhold enough to cover those taxes for you.

In cases like this, you may need to make estimated payments to avoid an underpayment penalty. Use our quarterly tax payments calculator to accurately figure out how much money to send.

What about shared tips?

If you share your tips with other employees, you can deduct the amount you gave to someone else from the tips you report. These indirectly-tipped employees must then report their portion of the tip income to your employer.

For example, say you earned $200 in tips and give $40 to the bartender and $25 to the busser. In that case, you’ll only need to report $135 when you fill out your Form 4070. ($200 - $40 - $25).

The bartender has to include the $40 in their tip report, and the busser has to include the $25 in their tip report.

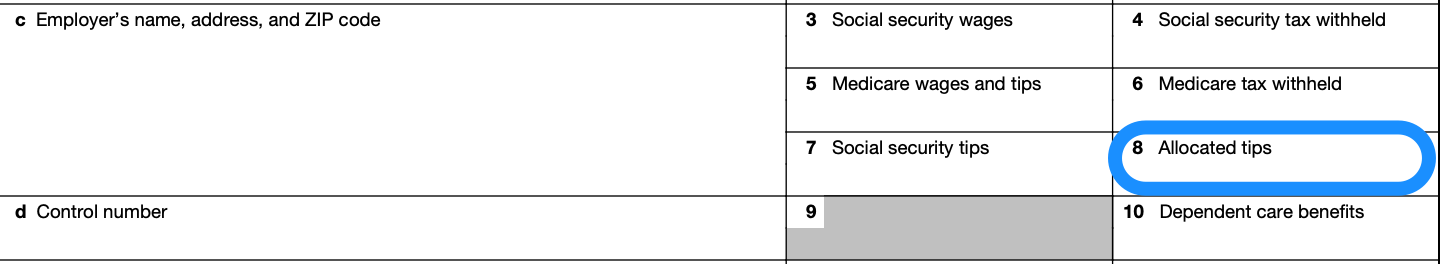

What about allocated tips?

If you work at a bigger restaurant you may have tips allocated to you. That’s because the IRS requires large establishments to allocate 8% of their total gross receipts as tip income to employees — even if they’re not actually paid out to employees.

Allocated tips can be a confusing concept to wrap your head around. Let’s talk about the thought process behind them.

How do allocated tips work?

Standard tipping rates range from 10-20%. So employees at a large restaurant collectively report less than 8% in tips, something was probably missed — or so the thought process goes.

Enter allocated tips. They’re a way of ensuring that all cash tips are accounted for, even if employees fail to report them.

Think of allocated tips as an on-paper adjustment or “reporting device” — not an actual payment you get. That’s right: they’re usually not paid out to employees. They’re simply a way for companies to meet their reporting requirements, without forcing them to account for every dollar.

Who has to deal with allocated tips?

Employees who report tip income of less than 8% for the pay period may get assigned allocated tips (even if, as we’ve mentioned, they don’t actually receive this amount in a check).

Here’s how it works: The company will calculate the difference between gross sales and reported tips at the end of each year (or pay period). If employee tips account for less than 8% of the company’s gross receipts for that pay period, the difference becomes allocated tips.

These allocated tips are listed separately on your W-2 under Box 8. You’ll include them as wages on your tax return.

Just like other unreported tips, employees will need to use Form 4137 to calculate Social Security and Medicare taxes on the income.

What if you received less than what’s allocated?

Employers can spread out the tip adjustment among their employees in a few different ways. For example, they might allocate the payments based on:

- Hours worked

- Gross receipts earned per employee

- A good-faith agreement

In some cases, the allocated tip adjustment isn’t calculated very precisely. (This is most common in restaurants with a large percentage of cash tips.) If that’s the case, it’s not uncommon for workers’ W-2s to report more tips than they actually received.

If this has happened to you, you don’t need to ask your employer to correct the W-2! Instead, you can simply report less than what’s stated on box 8 in your gross wages. As long as you’re able to document what you actually received in tip income, you can use the smaller amount.

Feeling uneasy? That’s understandable: usually we stress reporting the exact numbers listed on your W-2 to avoid having the IRS flag your return. In the case of allocated tips, however, adjustments are common — and expected. The IRS knows things can get imprecise, and gives specific permission in the instructions for employees to report the actual amount instead.

As long as you can support your numbers, you have nothing to worry about.

The key to handling taxes on your tips right is not waiting till tax time. Great recordkeeping during the calendar year will help you stay on the IRS’s good side.

Track how much you receive in tips and how much you share. And if you’re an independent contractor, don’t forget to keep up with your business expenses as well. These records are essential for your taxes, and they’ll be a lifesaver if you ever get an audit notice in the mail.

File complex taxes confidently

Upload your tax forms and Keeper will prep your return for you. 100% accuracy and maximum refund guaranteed. Plus, a tax pro reviews and signs every return.

Sign up for Tax University

Get the tax info they should have taught us in school

Expense tracking has never been easier

Keeper is the top-rated all-in-one business expense tracker, tax filing service and personal accountant.

Get started

What tax write-offs can I claim?